Loans that help you solve your car problems

In our daily tasks, we rely on our ability to move from one point to another. We humans have to move to survive, without movement we couldn’t get to work, buy groceries and toiletries or even go to important places.

Most of this problem can be solved by getting a car. A car really solves the travel problem, but cars break down and need to be repaired.

So how do you deal with car trouble, when all you can think of is “how to pay for car repairs without money when I need my car repaired but don’t know where to borrow »?

How Auto Loans Work

If you’re struggling with emergency car trouble, guess what, you’re not alone. Auto loans are also called car loans or car loans. These loans are sums of money taken out by borrowers to buy a new or used personal or utility vehicle.

Auto loans are secured unlike personal loans which are unsecured, the loan is used to purchase serves as collateral in an auto loan.

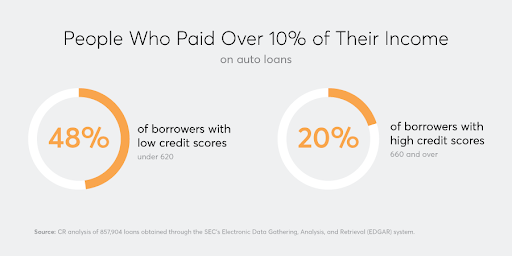

Today, the total number of Americans has increased dramatically over the past 10 years. On average 1 in 4 people spend 10% of their income on car debt.

Interest rates on car loans

Auto loans are secured loans taken out by people to purchase vehicles. The average interest rate for a car loan is 4.09% for new cars and 8.66% for used cars. Auto loan interest rates are provided as an annual percentage rate or APR.

The interest rate depends on various factors such as debt, income and credit rating. Credit score had a major influence on the interest rate, people with a credit score of 780 and above have a better chance of getting a loan with around 3% interest.

According to Experian Information Services, here are the applicable rates based on credit score

| CREDIT RATING | Average APR for a new car | Average APR for a used car |

| Super Prime

781-850 |

2.34% | 3.66% |

| First

661 – 780 |

3.48% | 5.49% |

| not first

601 – 660 |

6.61% | 10.49% |

| Subprime

501 -600 |

11.03% | 17.11% |

| deep subprime

300 – 500 |

14.59% | 20.58% |

How long do car loans last

Car loans are so important in the process of acquiring a car. The loans can last between a period of about 12 months to about 8 years. Auto loans are for 12 months.

Car loans: effect on credit score

Auto loans, like all types of credit services, have both good and bad effects on our credit score.

- The car loan is important in the acquisition of a car.

- Payment history accounts for 35% of our credit score.

- Paying off our car loan on time and within the repayment window positively affects our credit score.

Car loans do not affect the use of credit, which positively affects our credit score. Loans when not repaid can accumulate which negatively affects our credit score.

Battling with emergency car issues can be stressful enough, but knowing the right credit service to use takes a lot of the stress away.

According to American Automobile Associationthe average car upkeep that includes routine maintenance and repair in case of damage costs about $1,200, and only about a third of American drivers are financially strong to afford unexpected car repair costs.

Some automotive problems are covered by the vehicle’s warranty or insurance, but sometimes our vehicle may develop a fault that neither our warranty nor our insurance covers, so we have to pay cash, and situations may arise where we don’t have no cash on hand, there are few ways to get the funding we need, so let’s review

#1 Personal Loans

Personal loans are unsecured loans characterized by high interest rates. Personal loans can be used for a variety of things like home renovations, car repairs, vacations, etc. Personal loans for car repairs can be obtained at fitmymoney.com

#2 Credit cards

Credit cards are a way to pay for auto repairs that aren’t covered by insurance and warranty. Auto repairs can be placed on a card with an open credit limit.

#3 Payday Loans

Payday loans are also called payday advances. A payday loan is a short-term, unsecured loan, often characterized by a long interest rate. Payday loans are usually repaid when you get your next paycheck, but some lenders may give you more time to repay. Payday loans can be obtained to pay off automobile problems. Payday loans for auto trouble can be obtained at fitmymoney.com.

#4 Car Title Loans

Car title loans are short-term loans in which the lender deposits their car title as collateral to obtain a loan. When the borrowed money is repaid, within the repayment window which can last up to 30 days, the title of the car is returned, otherwise the person risks losing their car to the lender.

Conclusion

Car loans are very important in our daily lives, not only because they allow us to buy a car, but also because, if managed well, they can be a major way of increasing our credit score.

The loans available for repairing our cars are so important in filling the gaps in economic situations such that today only one-third of Americans can afford to maintain their vehicles without resorting to loans.