Insider Selling: Elevate Credit, Inc. (NYSE: ELVT) Insider sells 6,000 shares

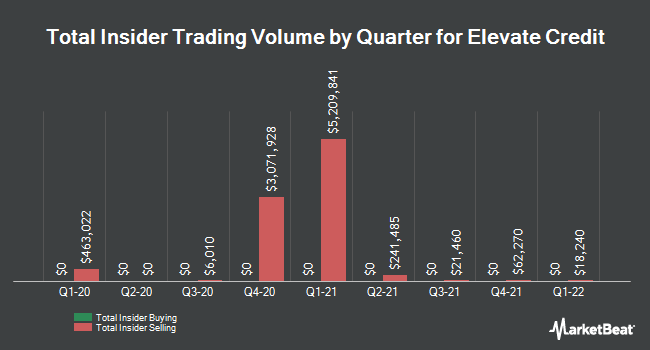

Elevate Credit, Inc. (NYSE: ELVT – Get a rating) insider David Curry Peterson sold 6,000 shares of the company in a transaction that took place on Thursday, April 7. The shares were sold at an average price of $3.04, for a total transaction of $18,240.00. Following the completion of the transaction, the insider now directly owns 94,973 shares of the company, valued at approximately $288,717.92. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available via this hyperlink.

David Curry Peterson also recently made the following trade(s):

- On Monday, February 7, David Curry Peterson sold 2,000 shares of Elevate Credit. The stock was sold at an average price of $3.32, for a total transaction of $6,640.00.

Shares of Stock ELVT opened at $2.99 on Wednesday. Elevate Credit, Inc. has a 1-year low of $2.54 and a 1-year high of $4.26. The stock’s 50-day moving average is $3.21. The company has a market capitalization of $93.39 million, a price-earnings ratio of -2.79 and a beta of 2.16.

Increase credit (NYSE: ELVT – Get a rating) last released its quarterly earnings data on Tuesday, February 15. The company reported ($0.42) earnings per share (EPS) for the quarter. Elevate Credit had a negative return on equity of 9.44% and a negative net margin of 8.06%. The company had revenue of $129.53 million for the quarter. During the same period of the previous year, the company posted EPS of $0.23.

Separately, Zacks Investment Research upgraded Elevate Credit shares from a “sell” to a “hold” rating in a Wednesday, Jan. 5 research report.

A number of institutional investors and hedge funds have recently increased or reduced their stake in ELVT. Walleye Capital LLC bought a new position in shares of Elevate Credit in the fourth quarter worth $39,000. Stokes Family Office LLC bought a new position in shares of Elevate Credit in the third quarter worth $48,000. Royal Bank of Canada bought a new position in shares of Elevate Credit in the third quarter worth $48,000. Two Sigma Securities LLC bought a new position in Elevate Credit during Q3 worth $49,000. Finally, Northern Trust Corp increased its stake in Elevate Credit by 20.5% during the 4th quarter. Northern Trust Corp now owns 39,330 shares of the company valued at $117,000 after acquiring an additional 6,702 shares in the last quarter. Institutional investors hold 47.22% of the company’s shares.

About Elevate Credit (Get a rating)

Elevate Credit, Inc. engages in the provision of online financial services for consumers of subprime credit. It provides online credit solutions to consumers in the United States and United Kingdom who are not well served by traditional banking products and who are looking for options other than payday loans, title loans, pledge and installment loans on display.

See also

Get news and reviews for Elevate Credit Daily – Enter your email address below to receive a concise daily summary of the latest news and analyst ratings for Elevate Credit and related companies with MarketBeat.com’s free daily email newsletter.