As Bitcoin Falls, NFTs Soar: Footprint Analytics Monthly Report

The crypto market downturn in December turned into a full downturn in January. DeFi activity declined while BTC and ETH prices fell. However, one asset has grown faster than ever.

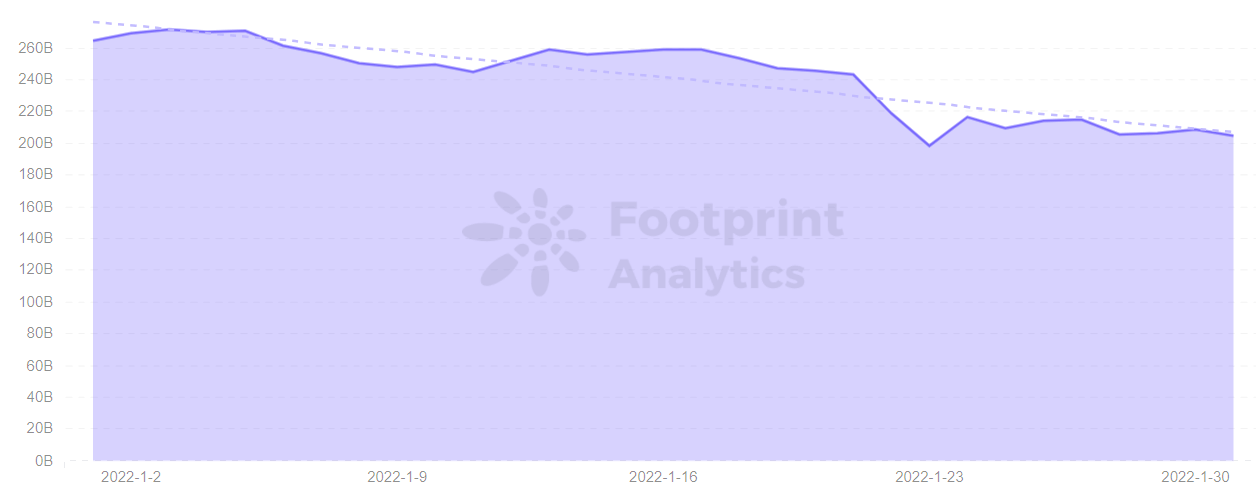

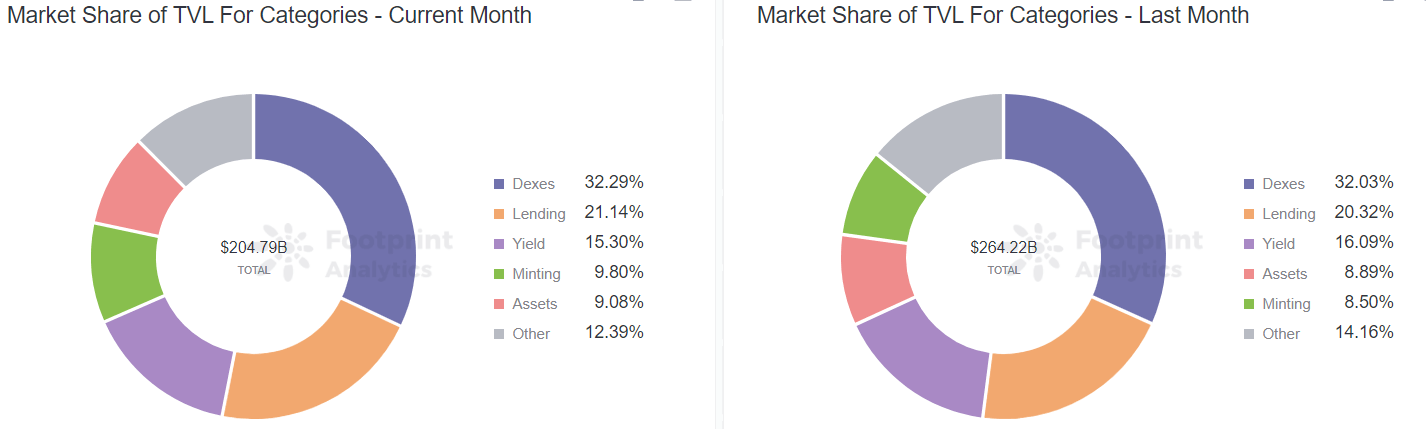

According to Footprint Analytics, DeFi’s TVL did not exceed $300 billion, falling to $204.79 billion, a drop of 22% MoM. BTC and ETH slumped again, while NFT market volume hit a new high in January, up 239%.

BTC, ETH Crash Again, Top Protocols Liquidated $425 Million

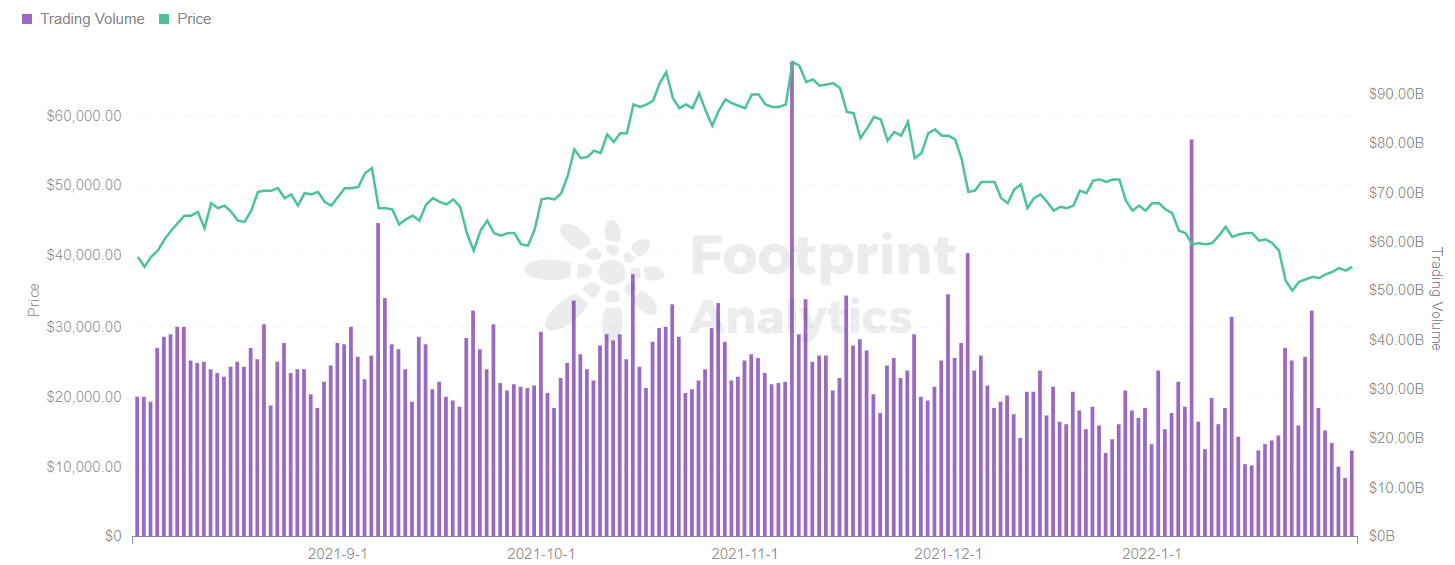

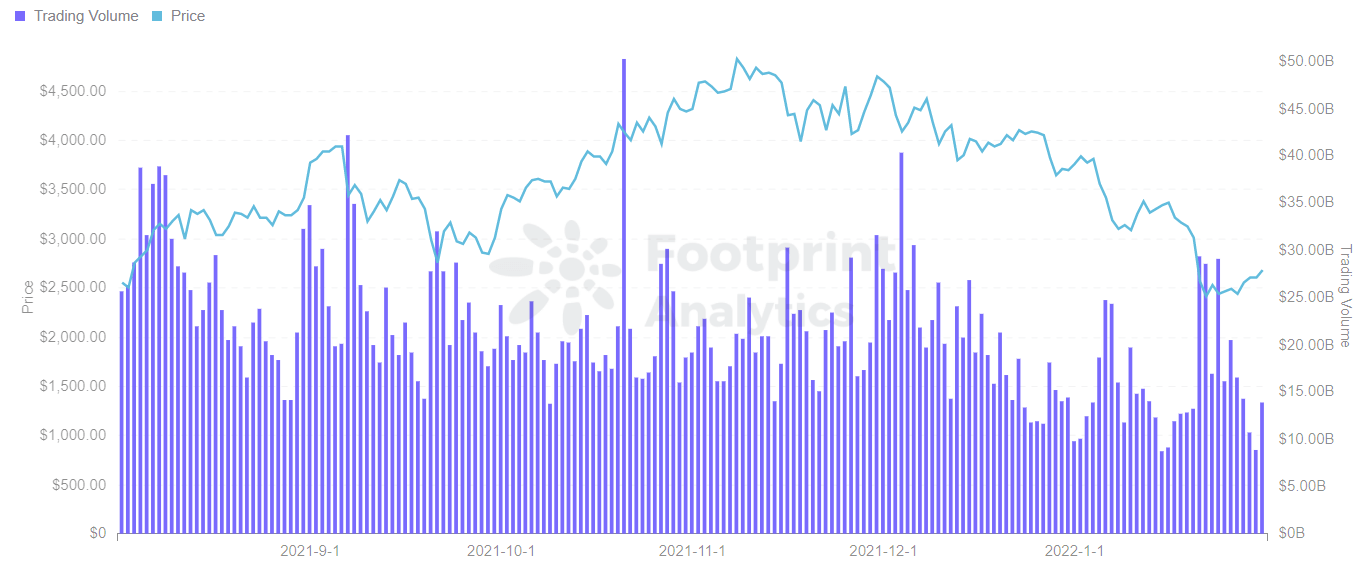

The price of BTC fell 17.3% from $46,472 to $38,430 in January. ETH fell 27.4% from $3,695.6 to $2,684.75, with the highest daily trading volume of the month at $29.31 billion. On the 22nd, BTC and ETH eclipsed their September 2021 lows.

The crash was mainly influenced by political announcements from various countries. Examples include the Federal Reserve’s monetary policy tightening, the Bank of Russia’s proposal to ban the use of cryptocurrencies, Pakistan’s ban on cryptocurrencies, and the strict regulation of BTC by d other countries, from mining and trading to online marketing.

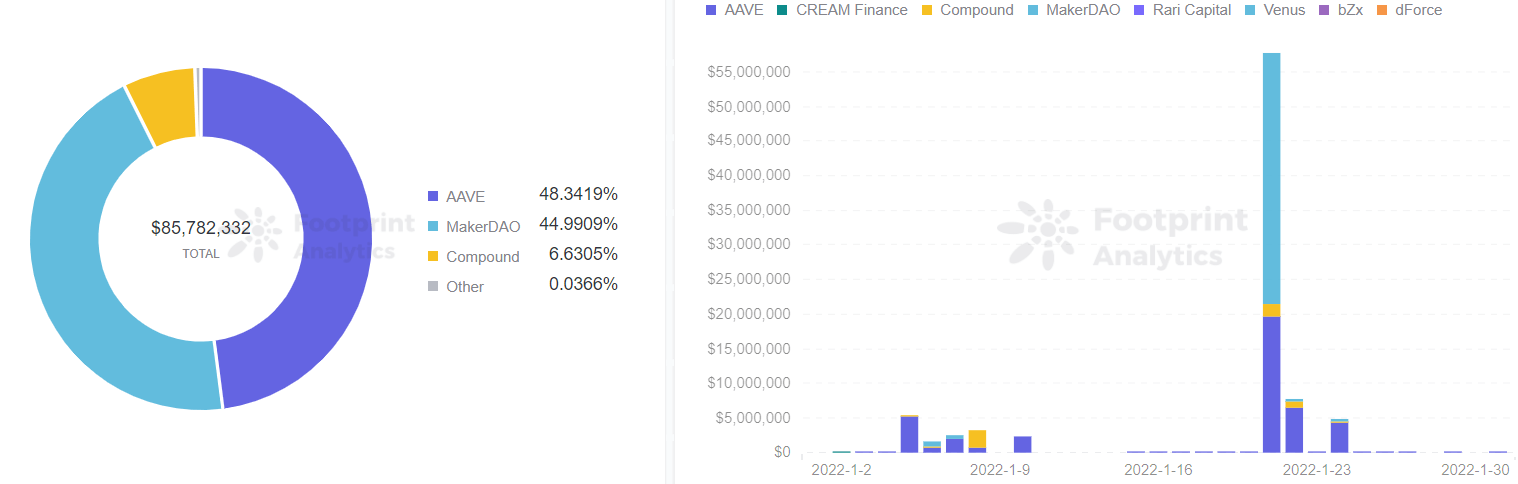

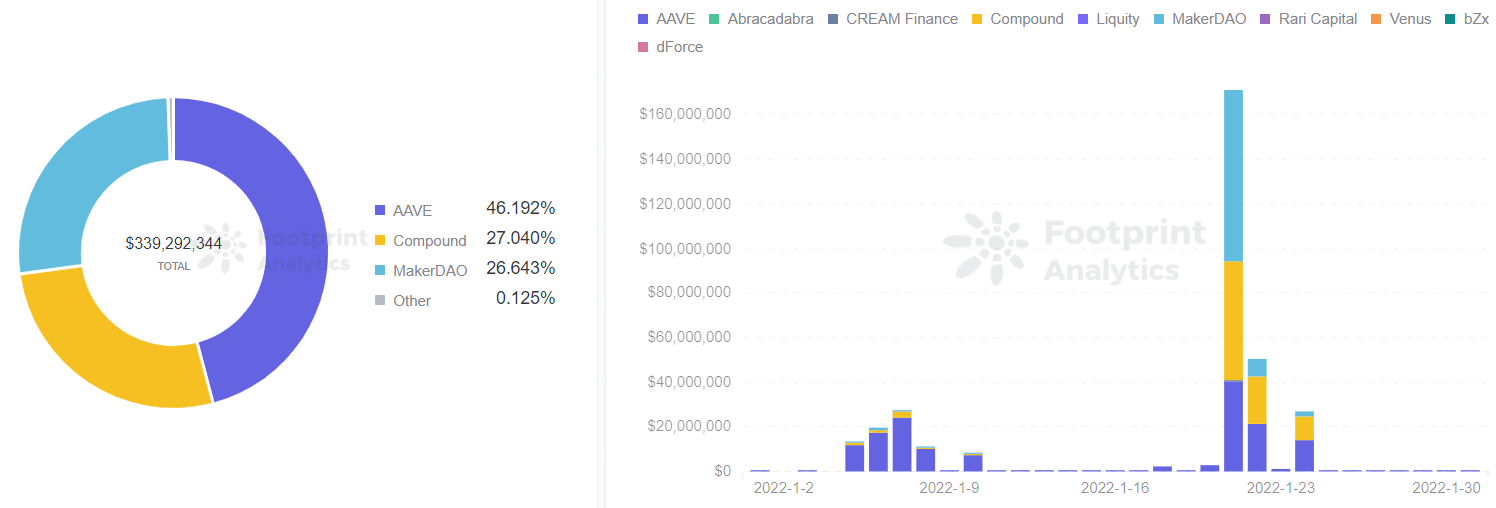

As BTC and ETH prices fell, this led to major lending protocols such as AAVE, Compound, and MakerDAO triggering massive liquidations around January 7 and 21, with $425 million liquidated.

DeFi TVL decreased by 22% MoM

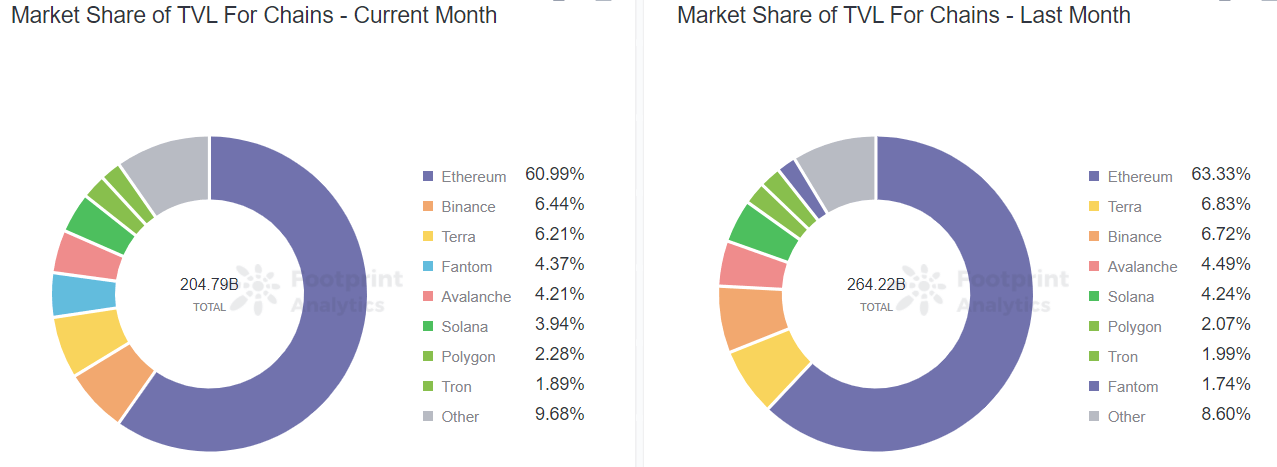

Due to the overall decline in the cryptocurrency market, TVLs fell 22% in January from $264.22 billion to $204.79 billion MoM. Data from Footprint Analytics shows that the TVL of bridge projects increased by 30%, which did not contribute much to the overall increase in DeFi TVL due to its low percentage.

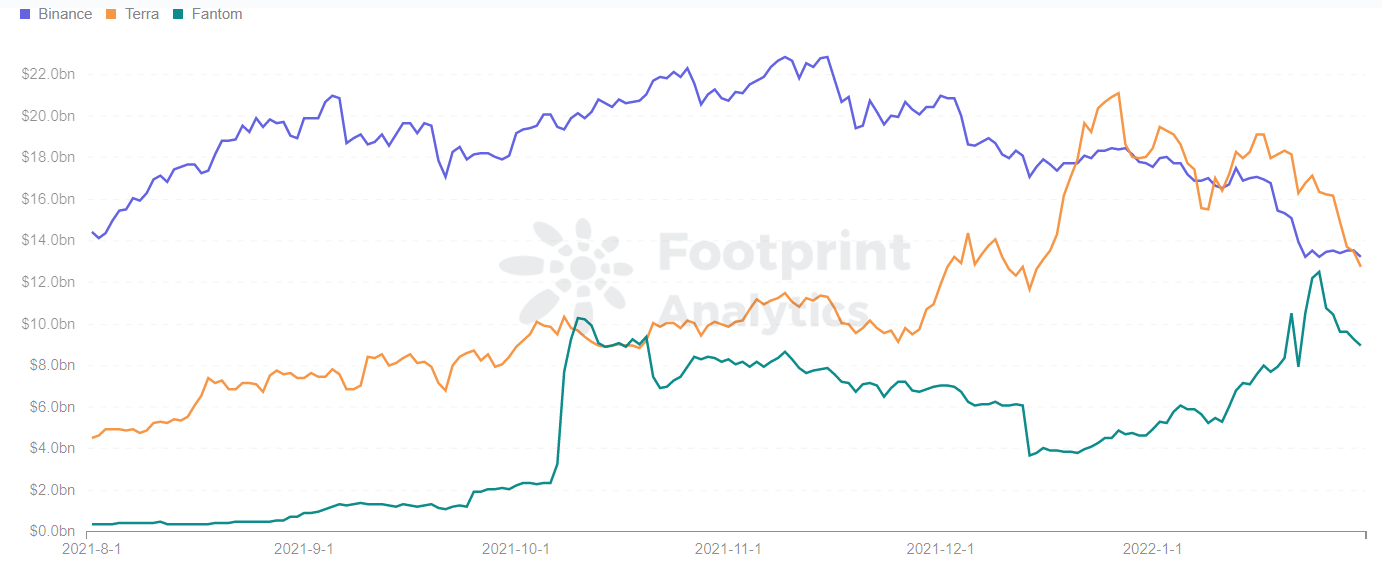

Fantom’s TVL hits blockchain all-time high

Blockchains are competitive and each has its own way of conquering the market. In January, Terra’s TVL had overtaken BSC several times in 2nd place. But at the end of the month, BSC overtook it to regain second place.

Fantom’s TVL reached an all-time high on January 25, locking in $8.9 billion at a 93% growth rate, surpassing Avalanche ($8.62 billion), Solana ($8.07 billion) and Polygon ($4.67 billion) in the top 4.

Fantom’s TVL reached an all-time high for the following reasons:

- Fantom is a faster (1-2s per transaction) and much cheaper (about $1 for 10 million transactions) alternative to the Ethereum network

- Fantom has a rich ecosystem with yield, dex and loan projects making up over 23% of the ecosystem, with Scream and SpookySwap contributing to TVL’s strongest growth.

- Scream supports depositing and lending of WBTC, WETH, WFTM, DAI, USDC, fUSDT, providing more liquidity.

- SpookySwap offers an APY above 100% to attract more users.

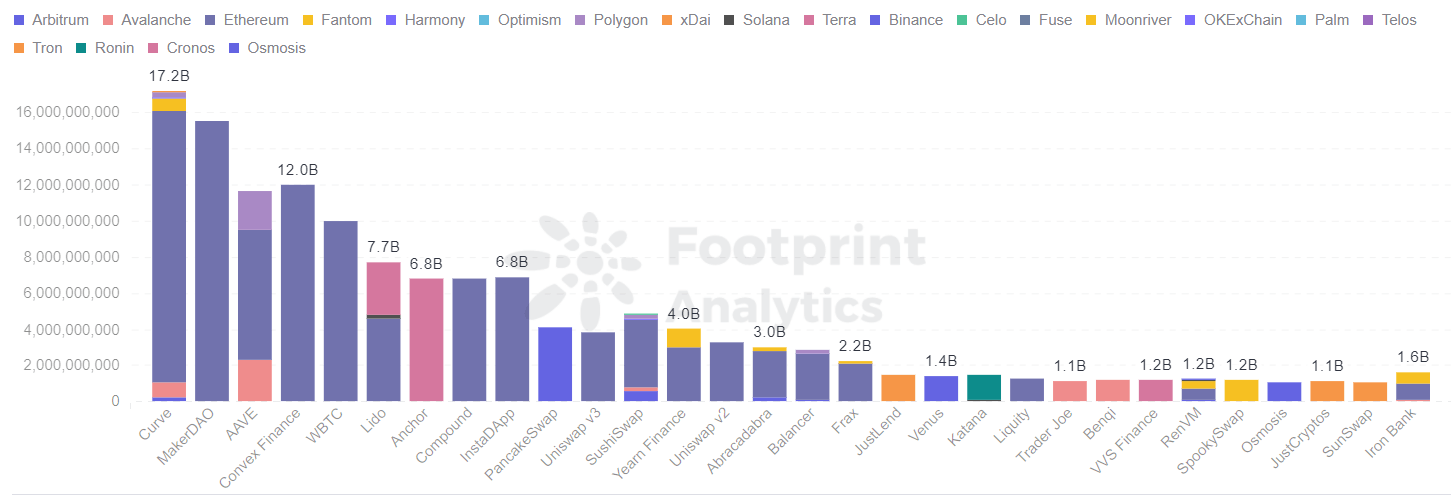

The curve is still far ahead

Curve is TVL’s number one DeFi platform and focuses on stablecoin trading. The drop in the price of BTC pushed down other cryptocurrencies like ETH, but had relatively little impact on the prices of stablecoins like USDT and USDC.

The top 5 spots continue to be held by popular projects such as Maker DAO, AAVE and Convex Finance.

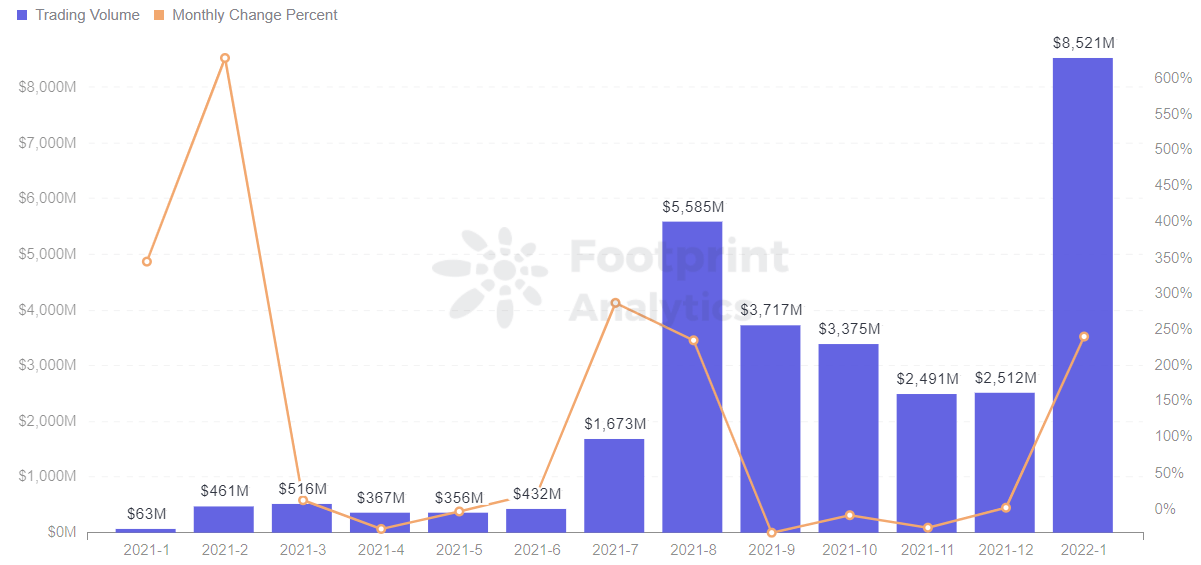

Monthly NFT volume hits record high of $8.52 billion, up 239%

With token prices falling due to the regulatory environment, speculative capital has flowed into the NFT market for collectibles, games, and art. This has led to unprecedented activity in the NFT space, with trading volume reaching a new high of $8.52 billion.

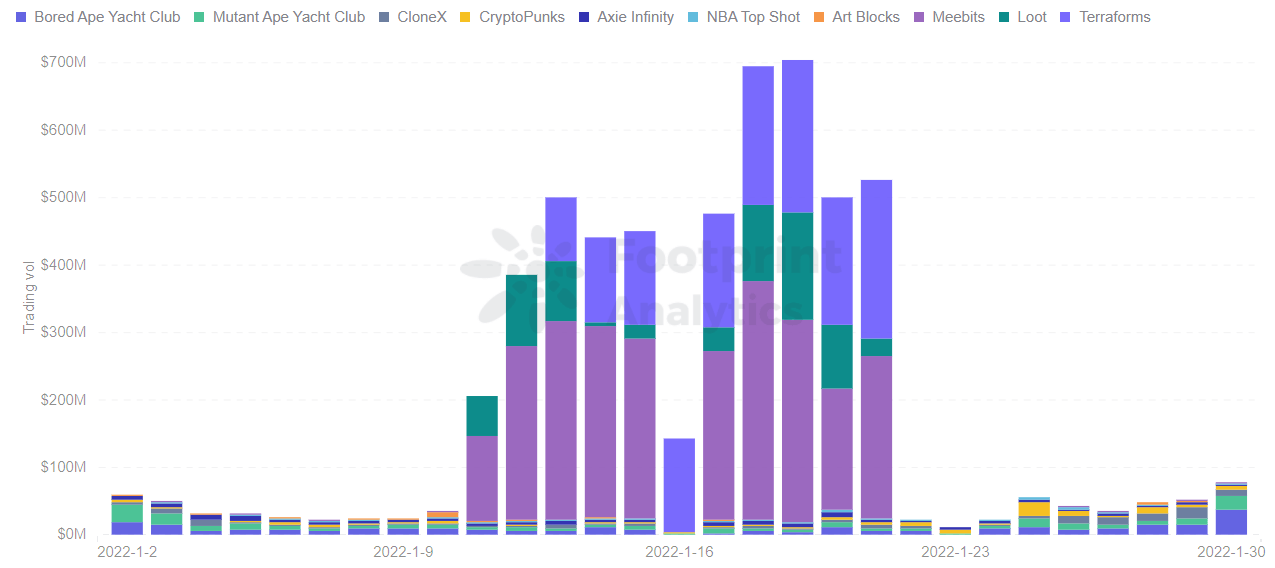

According to Footprint Analytics, Meebits saw an increase in transactions between January 11 and January 21, with volume reaching $200 million to $350 million. Meebits is a 3D virtual world game from Larva Labs, the Cryptopunks development team. The second most traded NFT project was Terraforms, and the third was Loot.

Veteran NFT collections such as Bored Ape Yacht Club, Cryptopunks, Art Blocks, and Axie Infinity had relatively stable daily trading volume.

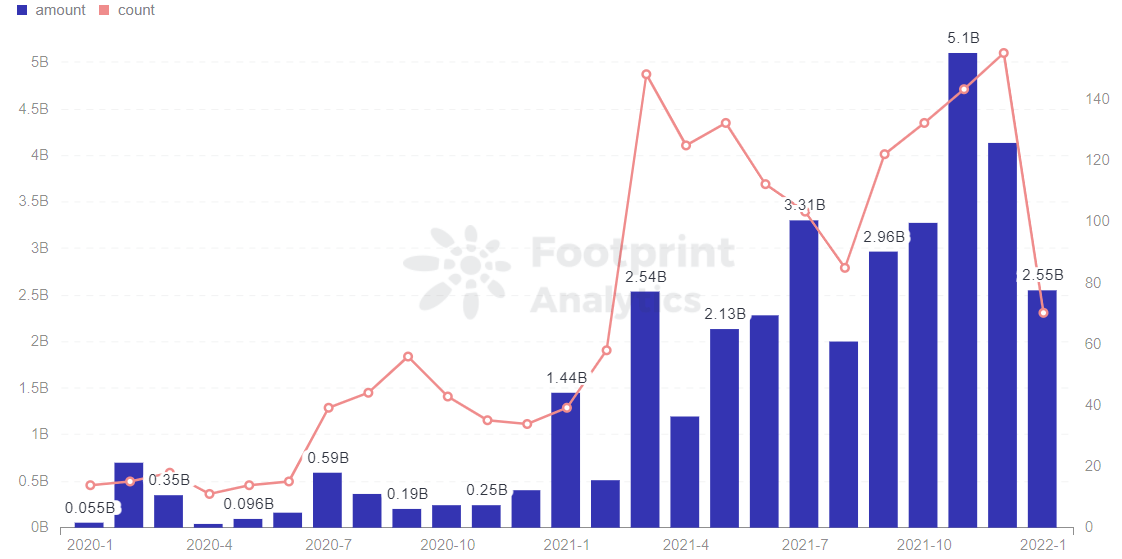

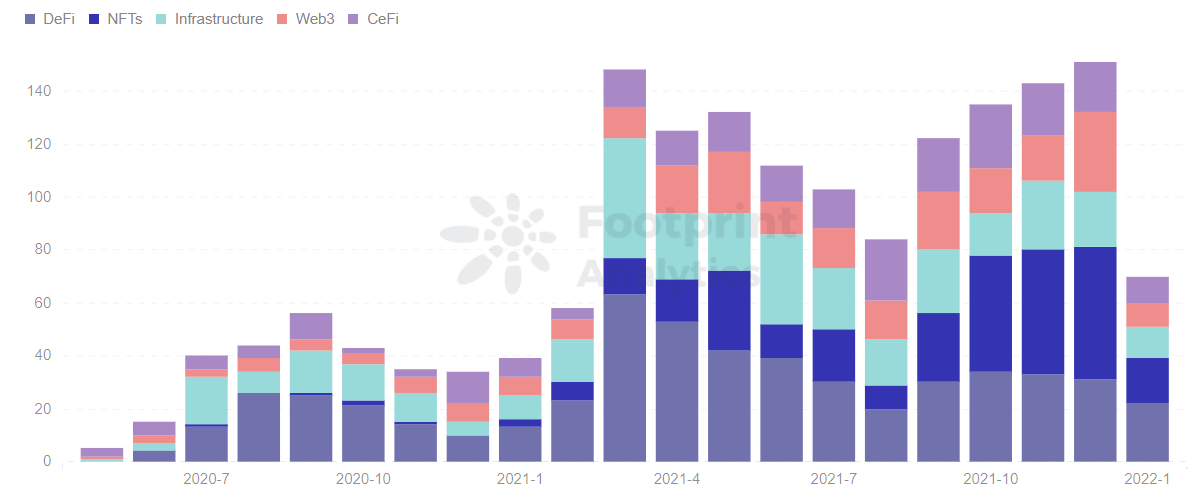

Monthly investment volume down 38% MoM

The number of investments in January was down 55% MoM and the amount invested was down 38%. In terms of investment sectors, the DeFi sector saw the smallest decline from December, while the NFT and Web3 sectors saw the largest declines, 66% and 70%.

Summary

Influenced by new policy proposals and regulations, the crypto market entered a downturn in January. Mainstream cryptocurrency prices have fallen, with BTC and ETH hitting lows. DeFi’s TVL fell by 21% MoM, implying a strong correlation with larger tokens.

However, falling ETH prices have helped NFT trading, prompting speculative capital to flow into NFT markets for collectibles, art, and games.

Review of January events

nations

- Pakistan’s FIA freezes 1,064 bank accounts used to trade cryptocurrencies

- Israeli Defense Minister Confiscates Over $800,000 in Cryptocurrency to Fund Military Activities

- BTCS becomes first Nasdaq-listed company to pay dividends in Bitcoin

- State Bank of Pakistan decides to ban cryptocurrencies

- Pakistan Telecom Authority ordered to block over 1,600 encrypted websites

- The White House wants to make crypto rules a matter of national security

- Uruguay installs its first cryptocurrency ATM

- Italian bank Banca Generali will allow BTC purchases early this year

Fund raising

- British Digital Bank Monzo completes $600m funding with a $4.5bn valuation. Tencent and others participate in the investment

- Horse Racing Chain Solana DarleyGo Game Completes Seed Round Funding, Jump Capital Leads Investment

- A16z Leads Additional $25M Round For Goldfinch DeFi Credit Protocol

- British Fintech PrimaryBid set to complete $150m funding from softBank

- Fireblocks Closes $550M Series E at $8B Valuation

- Navier Group Subsidiary Launches $100 Million Fund for Metaverse Creators

- Footprint Analytics Raises $1.5M to Create Accessible, IOSG-Led Cross-Chain Analytics Tool

blockchain

- Polygon (MATIC) plans long-awaited EIP-1559 update for next week

- Solana-based game project Nyan Heroes has partnered with YGG

- 24-hour trading volume on Fantom chain exceeds that of Ethereum

- Tether recovered $87 million in USDT sent to wrong addresses since launch

Challenge

- Convex Finance’s TVL exceeds $20 billion

- The total cryptocurrency market value fell to $1.8T, and BTC once fell below $36,550

- Protocol Cross-chain Bridge Multichain joins the SkyLaunch alliance

- Bitcoin Nouveau Riche Flows to Puerto Rico for Big Tax Savings

- Crypto Investment Agency Pantera’s Assets Under Management Hit $5.6 Billion

NFT

- Samsung will provide an “NFT aggregation platform” on its smart TV

- YGG has raised $1.4 million to help typhoon victims in the Philippines

- Pudgy Penguins NFT Project ousts founders as mood turns frosty

- A day after launch, OpenSea competitor LooksRare sells over $100 million in NFTs

- LooksRare’s Total NFT Market Trading Volume Exceeds $1 Billion

- January’s monthly NFT transaction volume hit a new high of $6 billion

Security

- The Solana network experiences a short-lived outage resulting in degraded performance

- LCX loses $6.8 million in hot wallet compromise on Ethereum blockchain

- Animoca Brands’ Lympo NFT platform hacked for $18.7 million

- Raricapital suffered severe price manipulation; Paidun said the stolen funds now amount to $250,000

- DEX Crosswise was hacked for $879,000

- Qubit decentralized lending protocol hacked, losing around $80 million

February 2022, [email protected] — Data Source: Footprint Analysis –January 2022 Report Dashboard

What is fingerprint analysis?

Footprint Analytics is an all-in-one analytics platform for visualizing blockchain data and uncovering insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects, and protocols. With over a thousand dashboard templates and a drag-and-drop interface, anyone can create their own custom charts in minutes. Discover blockchain data and invest smarter with Footprint.

CryptoSlate Newsletter

With a roundup of the most important daily stories in the world of crypto, DeFi, NFT and more.

Get one edge in the crypto-asset market

Access more crypto information and background in every article as a paying member of CryptoSlate Edge.

On-chain analysis

Price Snapshots

More context

Sign up now for $19/month Discover all the benefits